What Are The Tax Brackets For 2025 Nzd. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ). Calculate your take home pay from hourly wage or salary.

The new zealand tax calculator below is for the 2025 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in new zealand.

2025 Tax Code Changes Everything You Need To Know RGWM Insights, Income tax (paye) accident compensation corporation (acc) total tax. These are the rates for taxes due in april 2025.

Irs New Tax Brackets 2025 Romy Carmina, 2025 federal income tax brackets and rates in 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Kiwisaver, student loan, secondary tax, tax code, acc, paye.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, This means that the tax rate you pay on your crypto income will depend. March 27th, 2025 11:54 am.

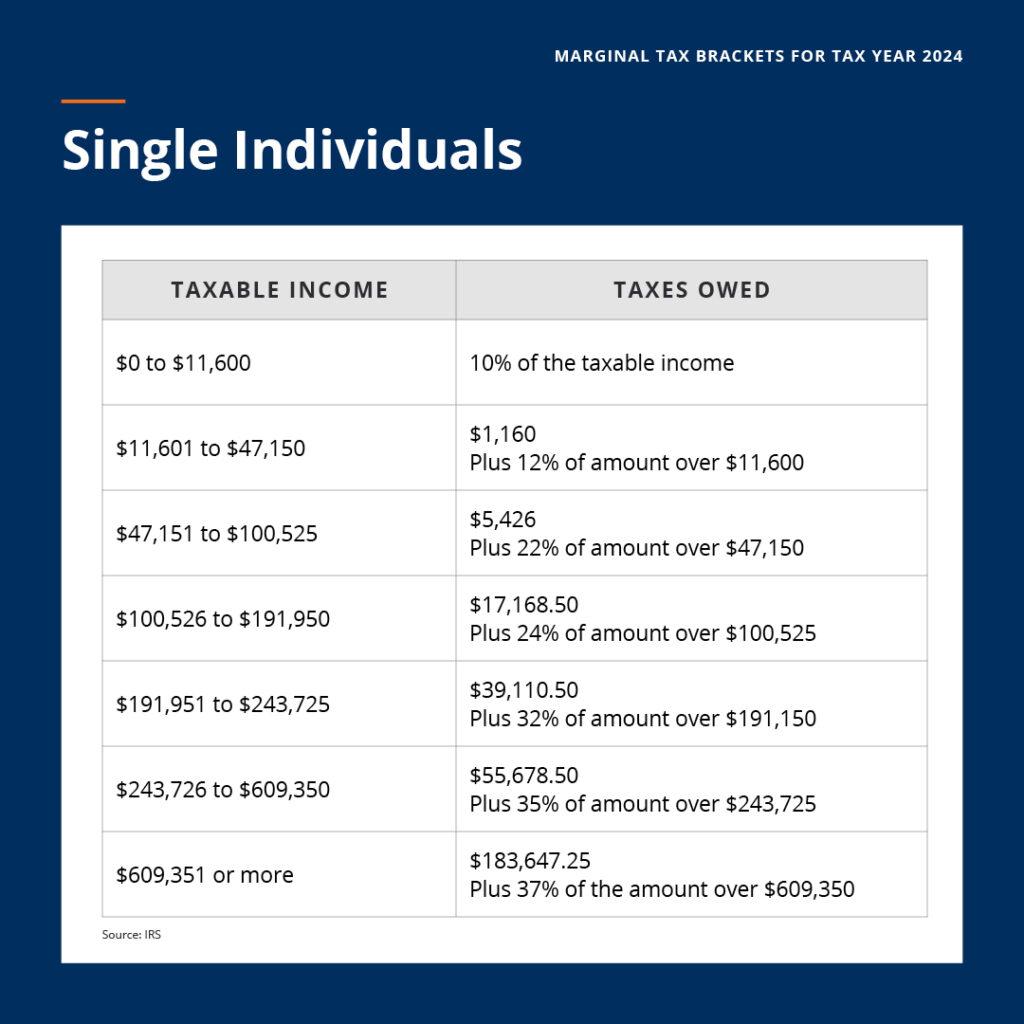

Tax Brackets 2025 Single Orel Tracey, How much of your income. For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples.

What Are The Different Tax Brackets 2025 Eddi Nellie, New zealand's best paye calculator. There are seven (7) tax rates in 2025.

A Guide to the 2025 Federal Tax Brackets Priority Tax Relief, Rs 1 lakh monthly income. Last updated 28 september 2025.

2025 Tax Brackets Announced What’s Different?, There areseven federal tax brackets for tax year 2025, and the irs has increased its income limits by about 5.4% in 2025 for each bracket. Income tax (paye) accident compensation corporation (acc) total tax.

2025 Tax Brackets Guide Stay Informed, Calculate your take home pay from hourly wage or salary. This means that the tax rate you pay on your crypto income will depend.

New Tax Brackets for 2025 YouTube, The income tax rates and personal allowances in new zealand are updated annually with new tax tables published for. 2025 federal income tax rates.

Tax Brackets 2025 Irs Table Jeni Robbyn, Kiwisaver, student loan, secondary tax, tax code, acc, paye. These rates apply to your taxable income.